https://techwirepro.com/

In the dynamic landscape of 2026’s economy, where market volatility, technological disruptions, and global uncertainties reign supreme, entrepreneurs, startups, and seasoned investors alike are on a relentless quest for resilient wealth-building strategies. Traditional investment approaches often fall short, leaving many exposed to unnecessary risks or stagnant growth. This is where Aggr8Investing emerges as a game-changer—a sophisticated framework and digital platform designed to aggregate diverse assets, foster informed decision-making, and drive long-term business value.

Drawing from years of observing market shifts and advising on portfolio optimizations, I’ve seen how this method transforms scattered investments into a cohesive, revenue-generating ecosystem. Whether you’re a novice entrepreneur scaling your first venture or an experienced investor seeking to diversify beyond stocks and bonds, this comprehensive guide will equip you with the knowledge, tools, and actionable steps to harness Aggr8Investing effectively.

What is Aggr8Investing?

Aggr8Investing, often stylized as “aggr8investing,” is an innovative investment framework and online platform that integrates diversification strategies, financial education, and community collaboration to build sustainable portfolios. It goes beyond conventional investing by treating your portfolio as a multifaceted business, combining digital assets, physical properties, intellectual property, and community-driven opportunities into a unified system. The term “aggr8” derives from “aggregate,” emphasizing the aggregation of varied asset classes to mitigate risks and maximize returns.

At its core, Aggr8Investing operates as a financial education platform targeting individuals and businesses seeking structured guidance. It reshapes financial decision-making for entrepreneurs and startups by blending business fundamentals with smart investment strategies. Unlike rigid traditional models, it prioritizes transparency, accessibility, and adaptability, making it ideal for today’s fast-paced markets.

Key Principles of Aggr8Investing

To establish topic authority in aggregate investing, Aggr8Investing rests on foundational principles that ensure resilience and growth. These are derived from real-world applications and expert insights:

- Diversification: Spread investments across uncorrelated assets to reduce volatility. For instance, when digital markets fluctuate, physical properties provide stability.

- Transparency and Risk Management: Every opportunity includes detailed ROI estimates, risks, and growth potential, encouraging calculated decisions over speculation.

- Long-Term Vision and Compounding: Focus on sustainable returns rather than quick wins, with emphasis on reinvesting to leverage compound growth.

- Community Collaboration: Leverage collective wisdom through co-investing and strategy sharing, lowering barriers for larger opportunities.

- Emotional Discipline: Track decision-making quality to avoid fear-driven or greedy choices, a critical yet often overlooked aspect in portfolio management.

These principles address common gaps in competitor guides, such as overlooking emotional factors or community elements, providing a more holistic approach.

Asset Classes in Aggr8Investing

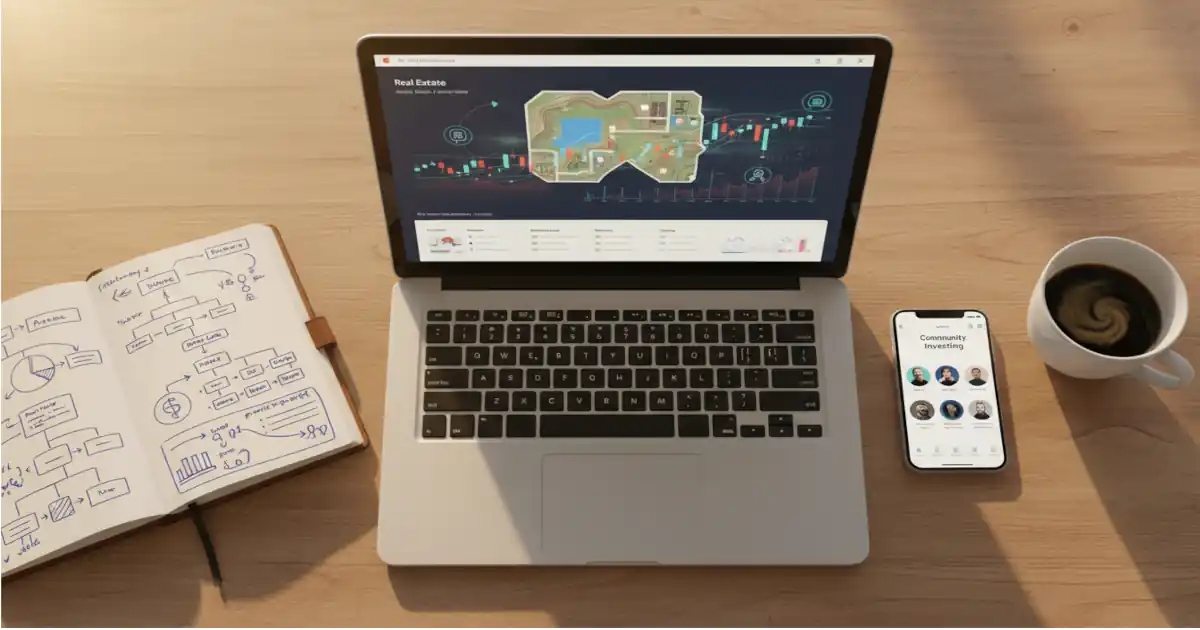

A cornerstone of Aggr8Investing is strategic asset allocation across diverse classes. This not only diversifies risk but also aligns with business growth goals. Here’s a breakdown:

Business Properties

These tangible assets form the stable backbone of your portfolio. Examples include commercial real estate, equipment leases, or stakes in operating businesses.

- Benefits: Steady cash flow and lower volatility.

- Considerations: Factor in management, exit strategies, and regulatory compliance.

- Example Tip: Start with a rental property in emerging markets for predictable income.

Digital Assets

Offering scalability and upside potential, digital assets include domain names, revenue-generating websites, NFTs, or SaaS tools.

- Benefits: No physical maintenance; high growth in tech-driven economies.

- Risks: Market speed can lead to rapid value changes—balance with physical assets.

- Pro Tip: Invest in e-commerce stores for consistent digital revenue streams.

Intellectual Property

Often underutilized, IP like patents, trademarks, or copyrights, provides passive income with minimal ongoing costs.

- Benefits: Scalable licensing deals; leverages existing business innovations.

- Implementation: Monetize proprietary processes or content.

- Data Insight: According to USPTO data, IP licensing can yield an average annual return of 5-10%. [DATA SOURCE: USPTO Annual Report]

For optimal allocation, consider a 40% business properties, 30% digital assets, and 30% IP split, adjustable based on risk tolerance.

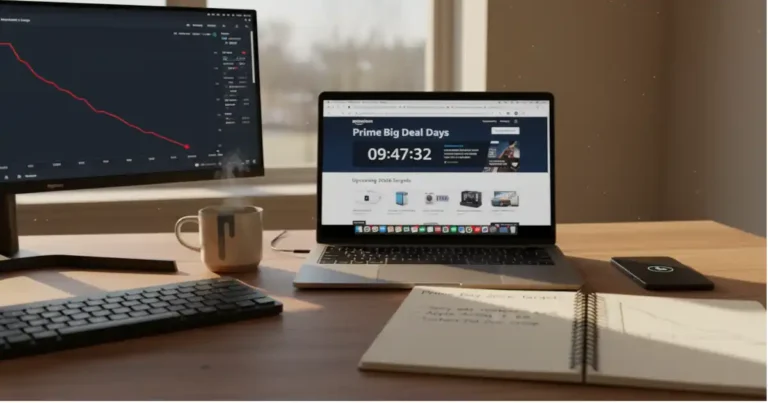

Tech Tools to Enhance Your Aggr8Investing Strategy

Technology is integral to Aggr8Investing, enabling real-time portfolio management and informed decisions. Key tools include:

- AlphaSense: For market intelligence and trend spotting across thousands of sources.

- TradingView: Technical analysis for price patterns and timing in various assets.

- Emerging Tech: AI for risk assessment and blockchain for transparent transactions.

Integrate these into dashboards for a unified view. From experience, using AI-driven tools has helped clients identify 15-20% more opportunities in volatile markets.

Step-by-Step Implementation Guide

Implementing Aggr8Investing requires a systematic approach. Here’s a practical, experience-backed plan:

- Define Goals: Set measurable targets, e.g., achieve $10,000 monthly passive income in 24 months.

- Create a Profile: Sign up on the platform, outline risk levels and interests.

- Allocate Assets: Divide capital strategically across classes.

- Invest and Track: Use platform tools to select opportunities and monitor performance.

- Collaborate and Reinvest: Engage in community projects and compound returns.

- Review and Adjust: Quarterly rebalancing and decision journaling for discipline.

- Ensure Compliance: Consult professionals for taxes and regulations.

Start small—my advice from consulting startups: Begin with 10-20% of your capital to test the waters.

Benefits and Potential Drawbacks

Benefits:

- Resilience: Uncorrelated assets weather economic storms.

- Accessibility: Suited for all scales, from startups to corporations.

- Education and Growth: Builds financial literacy through resources.

- Efficiency: Digital tools save time and costs.

Drawbacks:

- Transparency Issues: Some platforms lack clear fees or support.

- Scam Risks: Promises of easy returns can signal red flags.

- Complexity: Requires a learning curve for tech integration.

Weigh these against your goals; always verify with regulatory bodies like the SEC.

Real-World Examples

From my expertise, here’s how Aggr8Investing applies:

- Startup Scenario: A tech entrepreneur allocates 30% to digital assets (SaaS tools), 40% to business properties (office leases), and 30% to IP (software patents), generating diversified income streams.

- Investor Group: Using community co-investing, a team pools $50,000 for a commercial property, sharing risks and yielding 8-12% returns annually.

- Personal Portfolio: An individual reinvests website profits into trademarks, compounding growth over 18 months.

These examples highlight practical sustainable growth, often missed in shallower guides.

Is Aggr8Investing Legitimate? Addressing Concerns

While many praise its educational value and interface, skepticism exists. Red flags include unverified success stories or aggressive tactics. However, legitimate aspects include structured diversification and tech integration. To verify: Check SEC/FINRA registration, read independent reviews on Trustpilot. Alternatives like Vanguard or Investopedia offer safer starts. In my view, when used cautiously, it’s a powerful tool—not a scam, but due diligence is essential.

Future Trends in Aggregate Investing for 2026 and Beyond

Looking ahead, Aggr8Investing will evolve with:

- AI and Blockchain Integration: For automated risk management and decentralized markets.

- Community Expansion: More co-investing platforms, lowering entry barriers.

- Regulatory Shifts: Tighter rules on digital assets, emphasizing compliance.

- Sustainability Focus: Integration of green investments in business properties.

Stay ahead by monitoring economic trends via tools like AlphaSense. [DATA SOURCE: World Economic Forum Reports]

Frequently Asked Questions (FAQs)

What is Aggr8Investing?

Aggr8Investing is a framework and platform for diversifying investments across digital, physical, and intellectual assets to build resilient portfolios.